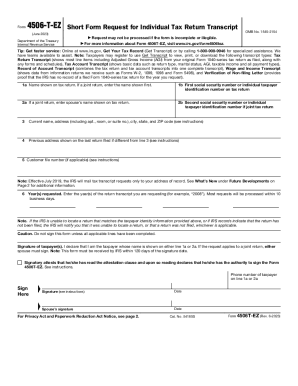

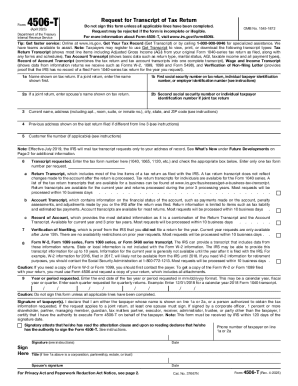

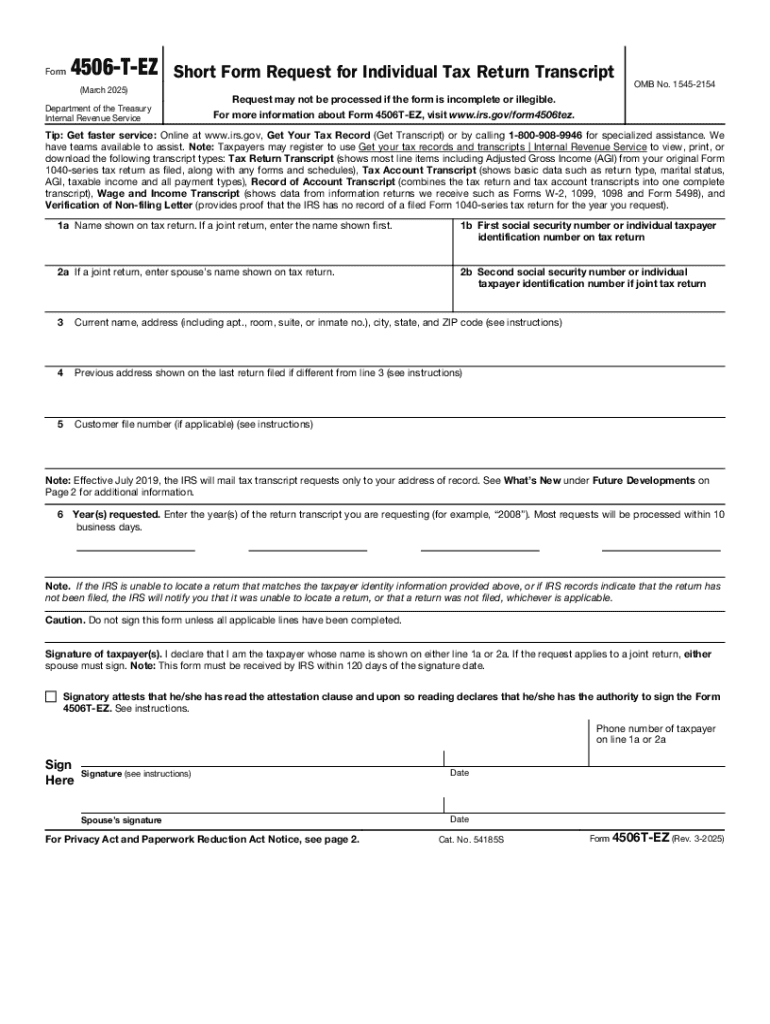

IRS 4506T-EZ 2025-2026 free printable template

Instructions and Help about IRS 4506T-EZ

How to edit IRS 4506T-EZ

How to fill out IRS 4506T-EZ

Latest updates to IRS 4506T-EZ

All You Need to Know About IRS 4506T-EZ

What is IRS 4506T-EZ?

Who needs the form?

Components of the form

What information do you need when you file the form?

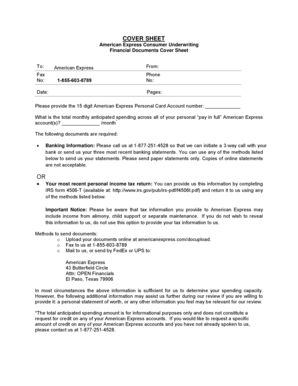

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

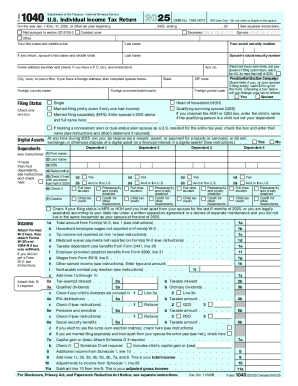

Is the form accompanied by other forms?

FAQ about IRS 4506T-EZ

What should I do if I realize there's an error on my submitted IRS 4506T-EZ?

If you discover an error after submitting your IRS 4506T-EZ, you should quickly prepare a corrected request and submit it following the standard procedures. This might involve sending a written explanation of the changes along with the corrected form. It’s advisable to track the submission status to ensure it is processed correctly.

How can I track the status of my IRS 4506T-EZ submission?

To verify the status of your IRS 4506T-EZ, you can use the IRS 'Where's My Refund?' tool if applicable, or contact the IRS directly for updates. Keep in mind that processing times can vary, and having your submission details will help when inquiring about your request.

What are some common errors to avoid when submitting the IRS 4506T-EZ?

Common mistakes include providing incorrect personal identification information, failing to sign the form, or sending it to the wrong address. Double-checking all entries and ensuring that you follow the IRS guidelines can help mitigate these issues while filing the IRS 4506T-EZ.

Can someone else file the IRS 4506T-EZ on my behalf?

Yes, if you designate an authorized representative through a Power of Attorney (POA), they can file the IRS 4506T-EZ on your behalf. Ensure that your representative has the necessary permissions and that the form includes your approval for them to act in this capacity.